When GE Aerospace and Safran Aircraft Engines struck the deal in 1974 that created CFM International, a 50-50 joint company between the two OEMs, it was with the intention of rewriting the playbook for commercial aircraft engine manufacturing. Now, 50 years on, as CFM marks 1.3 billion engine flight hours across its CFM56 and CFM LEAP engine lines, the stats speak for themselves.

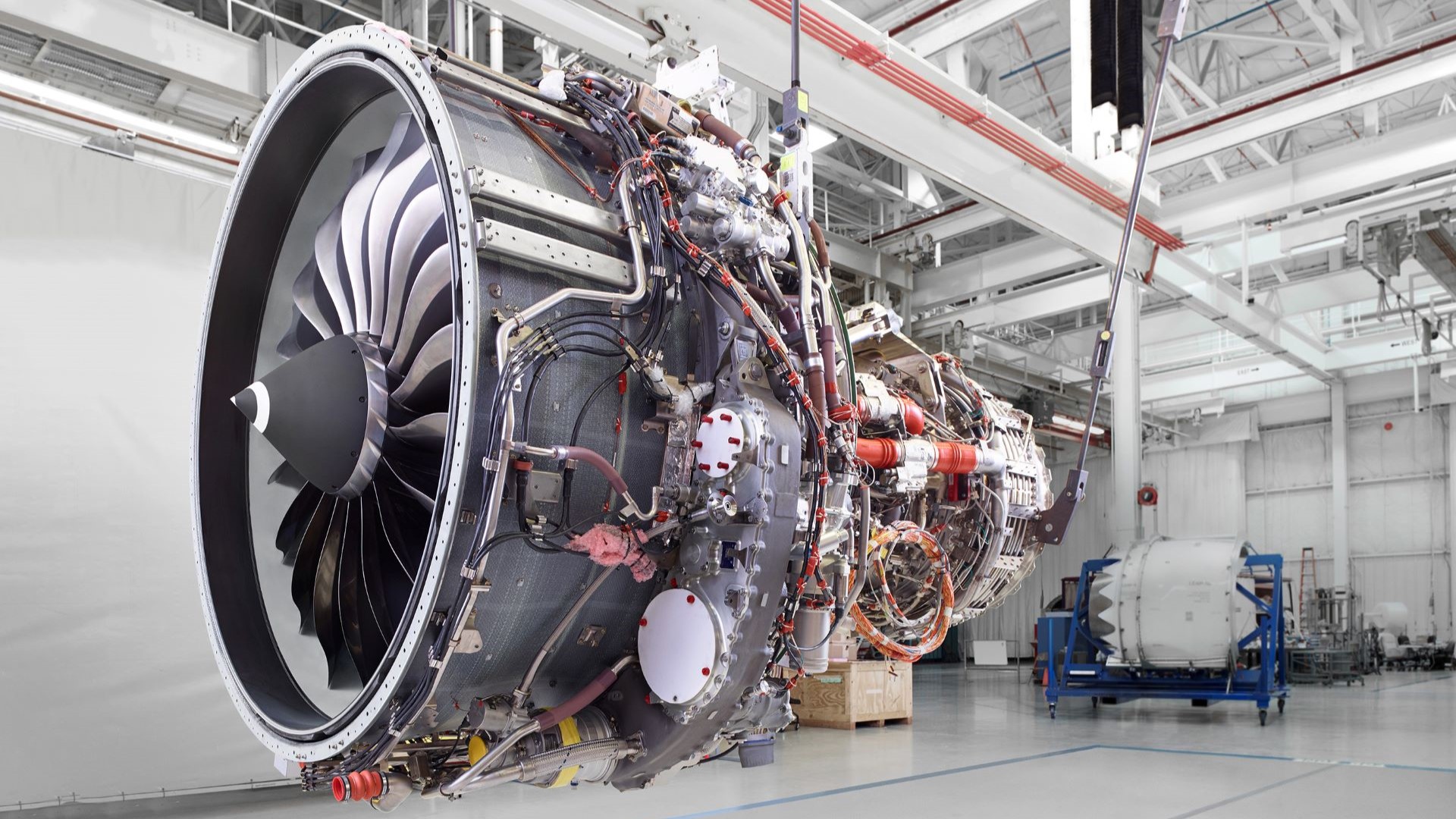

CFM56 engines power more than 14,000 commercial and military aircraft across more than 600 operators and are known for their reliability and durability. As they reach eight years in service, LEAP engines power more than 3,300 aircraft for nearly 160 operators and are rapidly maturing, with departure reliability rates comparable to those of the CFM56. The LEAP engine family powers all variants of Airbus A320neo, Boeing 737 MAX, and COMAC C919 passenger jets.

“Not only are LEAP-powered aircraft delivering 15% to 20% better fuel consumption and lower carbon emissions than the CFM56,” says Gaël Méheust, president and CEO of CFM International, “they’re doing it with even better performance retention than we predicted and the highest utilization in this thrust class.”

To be sure, it has been a remarkably successful run. But keeping all those planes flying safely and reliably, year after year, also requires attentive service. Which is why both parent companies are putting their money where their wrenches are, expanding overhaul capacity, repair development, and product maturity to meet growing demand.

GE Aerospace recently announced that it will invest $1 billion over the next five years in its maintenance, repair, and overhaul (MRO) network, including boosting repair and parts production for LEAP engines at numerous sites, and overhaul capacity for LEAP engines at its XEOS facility in Poland (which it operates in partnership with Lufthansa Technik), as well as MRO shops in Brazil and Malaysia.

At the same time, Safran Aircraft Engines is progressing in a similar ramp-up plan to grow its global overhaul and repair network for LEAP engines. The company just announced an additional investment of $80 million to construct a second MRO shop in Querétaro, Mexico, which is scheduled to begin operations by 2026. Safran Aircraft Engines has also recently inaugurated a new LEAP engine facility in Brussels, Belgium, in June 2024 and will open a new LEAP engine overhaul shop in India that is expected to be operational in 2025.

“As the LEAP engine fleet continues to grow, we are starting to see increased overhaul demand,” says Méheust. “To meet this demand, our parent companies are making long-term investments in manufacturing capability, overhaul capacity, and product maturity — with a focus on meeting our customers’ expectations for high performance and asset availability.”

MRO Capacity and Fleet Maturity

CFM has created an open LEAP MRO ecosystem that builds on the successful CFM56 model, in which customers can choose where to overhaul their engines. The open MRO ecosystem includes 35 sites: eight CFM shops for heavier work scopes, 11 CFM shops for lighter work scopes, five CFM-branded service agreement (CBSA) licensed shops that are increasing capacity for performance restoration shop visits, and another 11 licensed third-party providers. The five CBSA shops include some of the most reputable names in the industry: Air France Industries–KLM Engineering & Maintenance, Delta TechOps, Lufthansa Technik, ST Engineering in Singapore, and Standard Aero.

To improve engine durability and help reduce airline maintenance burden, CFM keeps innovating. The company recently announced that it is now shipping new LEAP-1A engines equipped with a reverse bleed system (RBS) designed to reduce on-wing fuel nozzle replacements related to carbon buildup. CFM is scheduled to release a service bulletin in July 2024 that authorizes RBS retrofits on LEAP-1A engines, and the company has pre-positioned retrofit kits to quickly ship to airline customers, overhaul shops, and third-party providers.

“We’re seeing good results from more than 100 RBS-equipped engines already in service with 24 customers,” says Méheust. “As we start retrofits, we’re also seeing the benefits of the open MRO ecosystem, with third-party providers adding RBS retrofit capability. This will help us upgrade the fleet much faster than if we had to rely only on our own facilities.”

“And the LEAP engine’s improved HPT blade is on track for introduction by the end of 2024,” adds Méheust. “It’ll help us achieve time on wing levels comparable to CFM56 engines in the same operating environment.”

Bright Future Ahead

Along with the LEAP engine, CFM continues to invest in the design and maintenance of CFM56 engines, about 45% of which have yet to see their first shop visit. The company’s efforts include an improved HPT blade for longer time on wing and an extensive portfolio of repairs and material solutions.

“We’re seeing high demand for the improved CFM56 HPT blade, of which we’ve already shipped more than 500 sets,” says Méheust. “These blades will help operators improve time on wing up to 25% in certain environments.”

CFM Materials, another GE Aerospace–Safran joint venture, has also been expanding its CFM56 engine portfolio and used serviceable material. “We’ve seen a surge in demand for CFM56 engines,” says Rudy Bryce, president and CEO of CFM Materials. “In fact, demand for CFM56-5B engines for the A320ceo family has recently increased to the level we’ve been seeing for CFM56-7B engines for the 737NG family.”

With about 40 overhaul shops around the world, more than 1,100 available repairs, and a growing CFM Materials portfolio, CFM56 operators have a broad set of solutions to keep their maintenance costs competitive and their fleets in the air. “The CFM56 fleet is still young,” says Bryce. “We see a bright future ahead for it, and for CFM Materials.”

Méheust concurs. “All told, with these investments and upgrades,” he says, “we’re extending time on wing for both CFM56 and LEAP engines. We also see a clear path to CFM56 levels of maturity for LEAP engines, and to meeting the ramp in MRO demand for both engine lines.”