GE Aerospace released its fourth quarter and full year 2024 financial results today, in addition to initiating its 2025 guidance. We encourage you to read the full materials and listen to our earnings call at 7:30 AM EST.

Key highlights of GE Aerospace's performance for the fourth quarter 2024:

- Total orders of $15.5B, +46%

- Total revenue (GAAP) of $10.8B, +14%; adjusted revenue* $9.9B, +16%

- Profit (GAAP) of $2.3B, +37%; operating profit* $2.0B, +49%

- Profit margin (GAAP) of 21.2%, +350 bps; operating profit margin* 20.1%, +450 bps

- Continuing EPS (GAAP) of $1.75, +62%; adjusted EPS* $1.32, +103%

- Cash from Operating Activities (GAAP) of $1.3B, +5%; free cash flow* $1.5B, +21%

Key highlights of GE Aerospace's performance for the full year 2024:

- Total orders of $50.3B, +32%

- Total revenue (GAAP) of $38.7B, +9%; adjusted revenue* $35.1B, +10%

- Profit (GAAP) of $7.6B, (27)%; operating profit* $7.3B, +30%

- Profit margin (GAAP) of 19.7%, (980) bps; operating profit margin* 20.7%, +330 bps

- Continuing EPS (GAAP) of $6.09, (27)%; adjusted EPS* $4.60, +56%

- Cash from Operating Activities (GAAP) of $5.8B, +26%; free cash flow* $6.1B, +28%

GE Aerospace Chairman and CEO H. Lawrence Culp, Jr. said, “GE Aerospace delivered a strong finish to 2024 given robust demand for our services and products with fourth quarter orders up 46%, EPS more than doubling, and free cash flow increasing over 20%. Our performance capped off a monumental first year as a standalone company with $1.7 billion of profit growth and $1.3 billion of free cash flow growth.”

Culp continued, "Looking to 2025, we expect double-digit revenue and EPS growth with greater than 100% free cash flow conversion. Guided by FLIGHT DECK, our proprietary lean operating model, I'm confident in our ability to accelerate output and deliver for our customers."

2024 was a year marked by several key achievements, including becoming a standalone company, launching FLIGHT DECK, orders for more than 4,600 commercial and defense engines, certification for the LEAP-1A HPT durability kit, and continued investment in the future of flight. Additionally, we returned more than $6 billion to shareholders, and today, announced an additional $7 billion in share repurchases in 2025, along with plans to raise our dividend by 30%, subject to Board approval.

Using FLIGHT DECK, we’re tackling supply chain constraints head-on. We saw a meaningful improvement from the first half to the second half of the year as material input improved 26% across our priority supplier sites. This supported Commercial Engines & Service (CES) services revenue growing 17% and total engine units growing 18% in the second half. While we’re encouraged by the improvements throughout the year, we’re confident that we will continue to drive further growth in 2025.

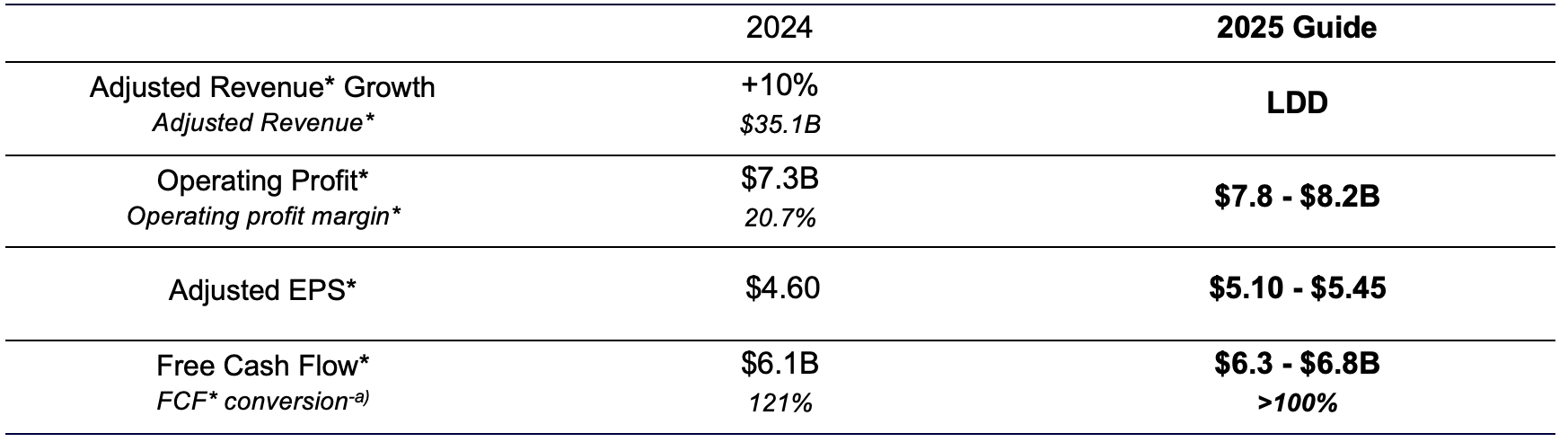

For 2025, GE Aerospace is initiating the following total company and business specific guidance:

Closing out our first year as a standalone company, our path forward is clear. We are confident in our ability to deliver another year of substantial adjusted revenue*, adjusted EPS*, and free cash flow* growth.

Finally, we are pleased to share some updates to our Investor Relations team. As you saw last week, Blaire Shoor has been named Head of Investor Relations. Read more about Blaire’s experience and expertise in our announcement here. Additionally, at the end of February, we are excited to welcome George Zhao to GE Aerospace’s Investor Relations team as Executive, Investor Relations. George has spent more than ten years in sell-side equity research, most recently as the lead Research Analyst covering European Aerospace and Defense. He will be a valued partner to our team, investors, and analysts with his deep industry knowledge and sell-side background. Sarah Schaeffler and Porter McManus will remain in their current roles.

Thank you for your continued interest in GE Aerospace,

GE Aerospace Investor Relations team

*Non-GAAP Financial Measure. The reasons we use these non-GAAP financial measures and the reconciliations to their most directly comparable GAAP financial measures are included in our fourth quarter earnings release.

(a-FCF* conversion: FCF* / adjusted earnings*

This document contains "forward-looking statements." For details on the uncertainties that may cause our actual future results to be materially different than those expressed in our forward-looking statements, see here.