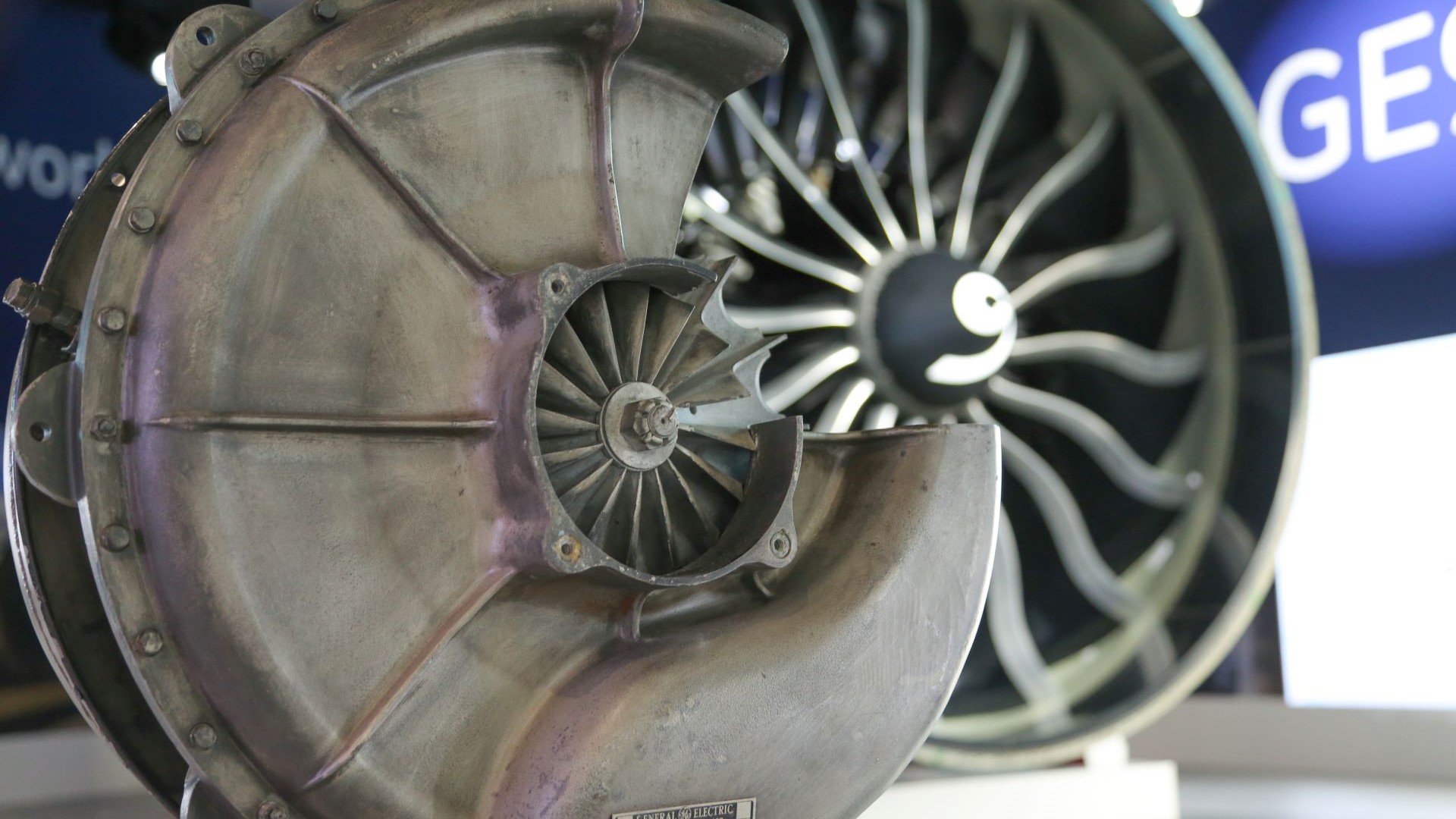

On June 19, 1918, Sanford Moss and his team of GE engineers reached the top of Pikes Peak, in the Rocky Mountains, and gazed down over the Great Plains of North America. They were laden not with backpacks but with a piston-powered, 12-cylinder Liberty aircraft engine, and a curious machine that looked like a large metal ammonite. Their piston engine roared to life, feeding hot exhaust gas into their seashell-shaped contraption. Normally, the Liberty engine struggled in the thin mountain air, losing around 35% of its power, but something different was happening this time around.

The engine performed exactly as if it were on the prairies 14,000 feet below, ticking up to its rated output of 352 horsepower. Their strange seashell was a turbosupercharger, squeezing the Liberty’s roasting exhaust gas into a denser, oxygen-rich jet and pumping it back into the piston engine’s carburetor. Moss and his team had just shown how an aircraft could fly higher without compromising on its brawn, opening a new chapter in the history of flight. It was also takeoff for GE, which entered the aviation business the following year.

More than 100 years after Moss’s triumph on Pikes Peak, GE Aerospace is launching as a standalone company. When the market opens at 9:30 a.m. today, GE Aerospace will begin trading on the New York Stock Exchange, retaining the familiar “GE” ticker. Some other things will remain unchanged as well: the company’s special sense of purpose, its unique capacity, and a steadfast determination to keep writing aviation history.

GE Aerospace Chairman and CEO H. Lawrence Culp Jr., said, “With the successful launch of three independent, public companies now complete — today marks a historic final step in the multi-year transformation of GE. I am tremendously proud of our team, their resilience, and their dedication to achieving this defining moment.”

Culp continued, “Building on a century of learning and carrying forth GE’s legacy of innovation, GE Aerospace moves forward with a strong balance sheet and greater focus to invent the future of flight, lift people up, and bring them home safely. With FLIGHT DECK, our proprietary lean operating model, as our foundation, I am confident we will realize our full potential in service of our customers, employees, and shareholders.”

The Future of Flight

Moss’s turbosupercharger was the first of GE Aerospace’s many gifts to aircraft propulsion. It built America’s first jet engine, the first turbojet engines to power flights at two and three times the speed of sound, and the world’s first high-bypass turbofan engine to enter service. Throughout the years, GE Aerospace’s scale has kept pace with its invention. Today it boasts an installed global base of approximately 44,000 commercial engines — including renowned products such as the GEnx, on the Boeing 787, and the CFM International* LEAP engine, in collaboration with Safran Aircraft Engines — and around 26,000 military and defense engines. As you read this, around 900,000 people are flying on GE Aerospace–powered aircraft. That’s a tremendous responsibility that it takes seriously, which is why the standalone company’s operating framework will remain unchanged: safety, quality, delivery, and cost (SQDC) — in that order.

GE Aerospace is much more than a jet engine inventor extraordinaire. It launches today as an established global leader in aviation services and systems sectors, too. The company generated approximately $32 billion in 2023, with 70% of total revenue generated by services and the strong economics of the engine aftermarket. The company is pioneering advancements in its maintenance, repair, and overhaul (MRO) network, aka “the greatest leading indicator program in the world” for gauging engine performance.

The company is planning investments this year of around $650 million in manufacturing facilities and supply chain to boost production and enhance product quality. It will continue to draw on its deep engineering expertise to develop next-generation technology. This includes CFM International’s Revolutionary Innovation for Sustainable Engines (RISE) program. RISE will advance a suite of new technologies, such as open fan architecture, with the aim of achieving at least 20% better fuel efficiency and 20% lower CO2 emissions than the most efficient engines today. To date, CFM has completed more than 100 tests as part of the RISE program.

The company is also inventing the future of more electric flight, working with NASA and Boeing to develop an integrated, megawatt-class hybrid electric propulsion system for ground and flight tests this decade. Hybrid electric propulsion technologies can help improve engine performance, which reduces fuel usage and carbon emissions.

FLIGHT DECK to the Fore

Underpinning everything that GE Aerospace does will be a proprietary lean operating model called FLIGHT DECK — a systematic approach to running the business to deliver exceptional value as measured through the eyes of its customers. Focused on driving safety, quality, delivery, and cost improvements, this operating model is helping GE Aerospace accelerate its lean progress to drive better results for customers and deliver on its purpose today, tomorrow, and in the future.

At the heart of FLIGHT DECK are 10 fundamentals that will help the company deliver value for its customers. One of the fundamentals is continuous improvement, or “kaizen,” a multiday event at which teams made up of management and frontline manufacturing employees gather for “genba” — which means “the actual place” where the work gets done, such as the shop floor. They’ll comb through every aspect of a production or business process, hunting for ways to eliminate waste and create more value with fewer resources using data-driven, team-oriented, structured problem-solving.

“These 10 fundamentals come together, and they shape how we do the work that we do,” Culp says.

Firm Financial Footing

Such approaches have enabled GE Aerospace to begin life as an independent company on the firmest of operational and financial footings. Since 2018, the parent company has reduced debt by more than $100 billion and returned nearly $2 billion to shareholders through dividends and buybacks. At the company’s Investor Day in March, GE Aerospace reaffirmed its 2024 guidance and presented a longer-term financial outlook, including achieving approximately $10 billion of operating profit in 2028. GE Aerospace also outlined a capital allocation framework to invest in growth and innovation from the get-go, while also returning approximately 70% to 75% of available funds through dividend and share buybacks.

Today’s launch marks the successful completion of GE’s multi-year transformation. GE Aerospace now begins operation alongside investment-grade industry leaders GE HealthCare and GE Vernova. “Looking ahead, our financial outlook demonstrates confidence in our future, with a robust market and demand for our products and services underpinning continued growth across revenue, operating profit, and cash generation,” said Culp on Investor Day.

When the bell rings today, GE Aerospace is assured of a smooth takeoff. And the inventive spirit of Moss and his merry band on Pikes Peak in 1918 is still the air beneath its wings.

GE Aerospace will issue its first-quarter earnings on April 23, 2024, and will host its earnings call at 7:30 a.m., which can be accessed here.

*CFM International is a 50-50 joint company between GE Aerospace and Safran Aircraft Engines.